Dune Digest 016

Polymarket & Kalshi, Kaia USDT, EulerSwap, Hyperliquid, Uniswap v4 hooks

Exclusive content

Download Content

Polymarket and Kalshi, the InfoFi Unicorns

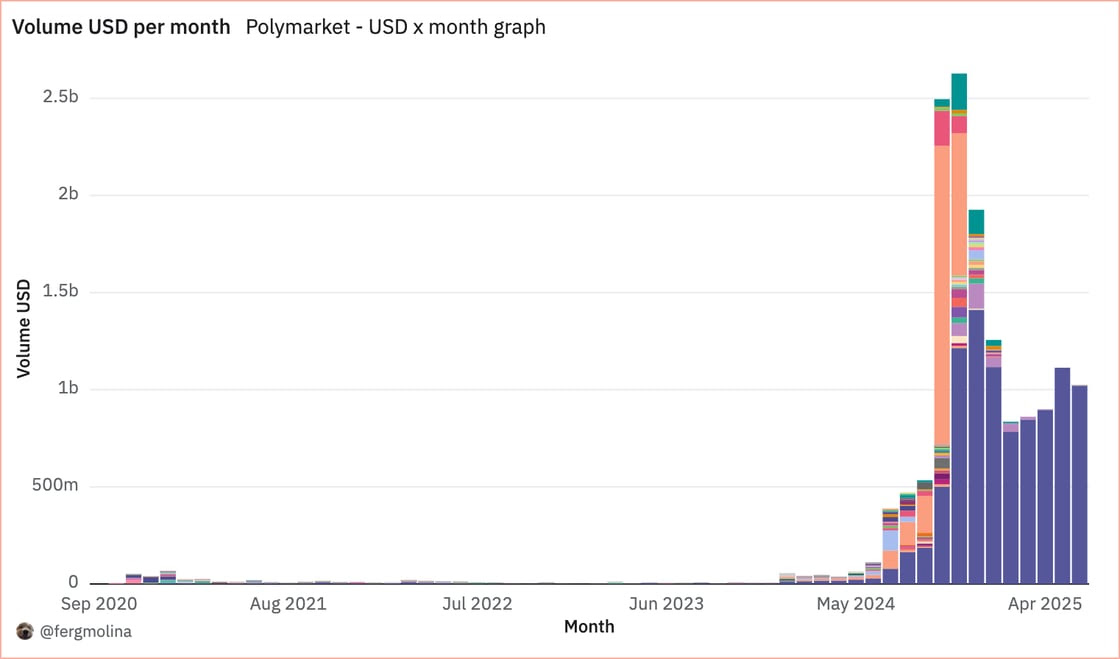

Two of the biggest players in the prediction markets space made headlines almost simultaneously this past week: Polymarket is reportedly raising $200M at a $1B valuation led by Founders Fund, while Kalshi closed a Paradigm-led $185M round at $2B valuation. Despite regulatory hurdles that limit its accessibility, Polymarket continues to show strong demand. After dipping from a $2.6B peak in November 2024, volume has been steadily rising and surpassed $1B in June 2025. Adding to the momentum, X announced a partnership with Polymarket to integrate real-time prediction data, Grok’s AI analysis, and X posts into a shared product delivering live, data-driven insights. Prediction markets like Kalshi and Polymarket are shaping up to be early pillars of InfoFi, where information is not just shared but valued, traded, and monetized directly.

Kaia Brings Native USDT to 196M LINE Users

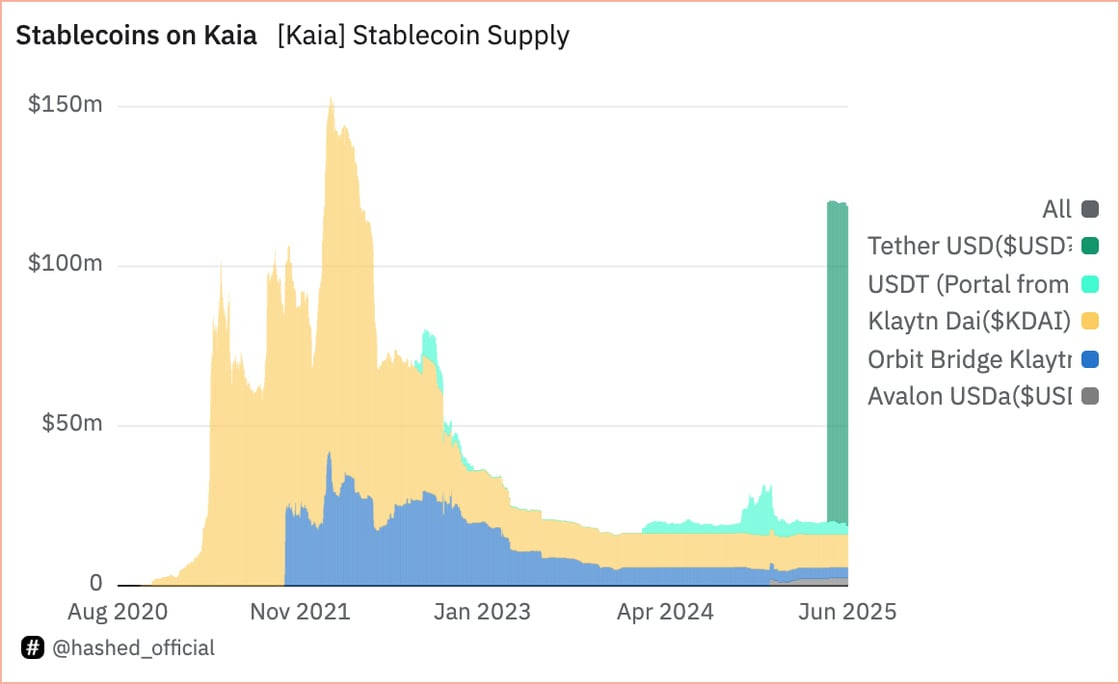

In May, Kaia launched native support for USDT, and this week, Hashed Official just published the first onchain data showing $100M in USDT supply. While user activity has normalized from April’s record 5.5 million daily active accounts to around 500K, the addition of native USDT marks a key step in expanding Kaia’s utility and enabling more stablecoin-based applications across its ecosystem. Through LINE NEXT’s Mini Dapp platform and self-custodial wallet, users can now send, receive, and use USDT for payments, rewards, and DeFi. As Kaia positions itself as a gateway for dollar-backed stablecoins in Asia, the launch of native USDT marks a major step in bringing stable, accessible Web3 experiences to mainstream consumers.

EulerSwap Hits $300M+ in Beta

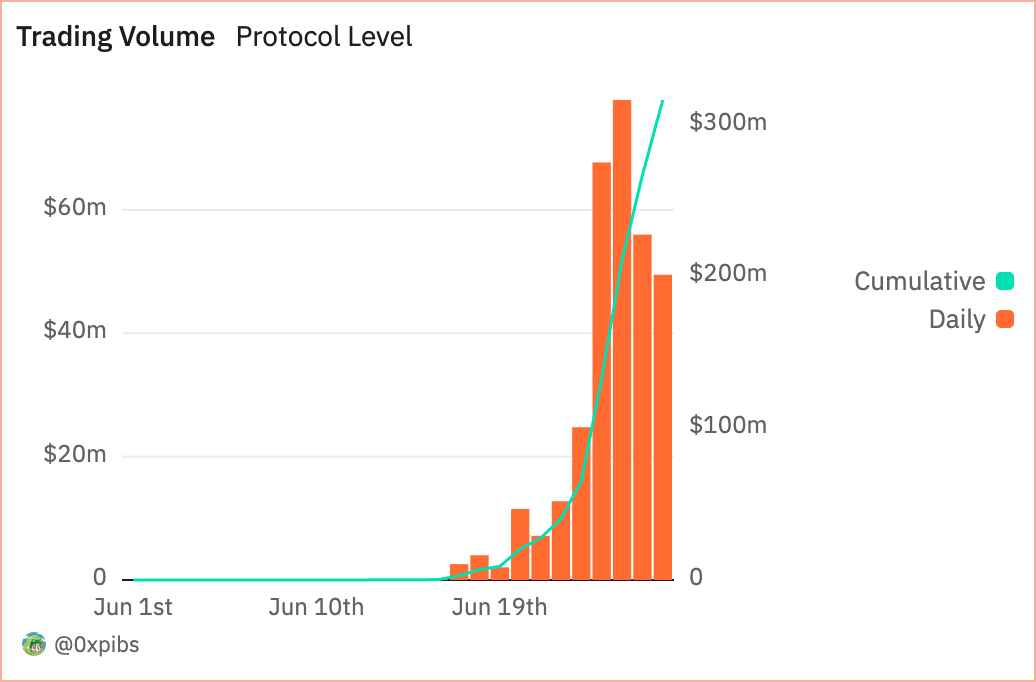

Euler, the DeFi lending protocol, has launched its own DEX, EulerSwap, and it's already crossed $300M in cumulative trading volume while still in beta. Built on top of Uniswap v4’s hook architecture and deeply integrated with Euler’s lending vaults, the DEX allows LPs to earn swap fees, lending yield, and borrow against positions, all with the same capital. This unified design unlocks new levels of capital efficiency for DeFi traders and liquidity providers. While EulerSwap pushes the protocol’s reach wider, Euler is also going deeper, expanding its core lending product to Arbitrum this week.

Hyperliquid Tops $1.5T Volume and $300M Revenue

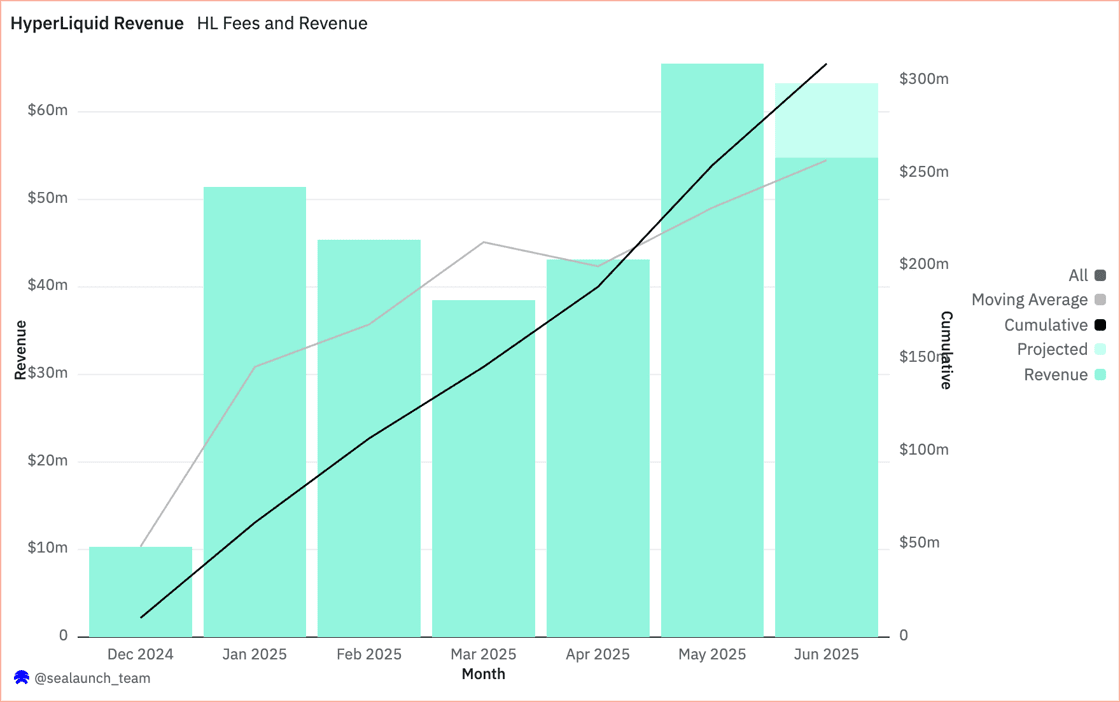

The new Hyperliquid’s dashboard by Sealaunch reveals the scale of its performance: $1.57 trillion in annual perp trading volume, $309 million in cumulative revenue, and over $3.5 billion in bridge TVL. Monthly revenue remains strong, with $55 million generated in June alone. Built from first principles with custom infrastructure, including the HyperBFT consensus and HyperCore execution engine, Hyperliquid offers fully onchain perps with one-block finality and support for 200K orders per second. As the protocol scales and deepens its market share in onchain derivatives, developers now have access to HyperEVM data via Dune’s Sim API, unlocking deeper integrations and use cases.

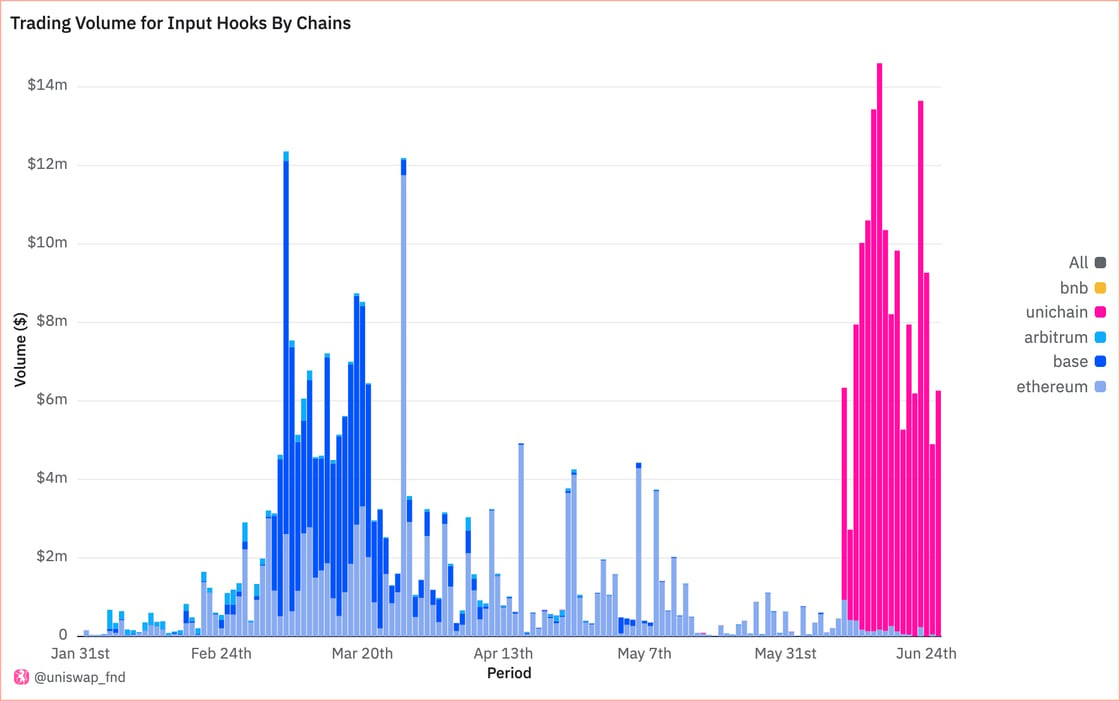

Uniswap v4 Hooks Top $380M Volume

Roughly two weeks after Uniswap announced its first Hook Design Lab cohort, hook-enabled pools are quietly gaining momentum. Total hooked pool volume has surpassed $382M, with June averaging around $8M per day, driven largely by activity on Unichain. Among the top-performing hooks are EulerSwap ($325M total volume), Bunni ($388M), and Aegis ($70M), all part of Cohort 1. Others like Kyber, Zora, and Gamma Strategies are also seeing growing volumes without incentives. The hooked share of Uniswap v4 volume is now approaching 4%, signaling growing traction for this modular new paradigm in AMM design.

Nothing in this newsletter constitutes financial advice.

Always do your own research.

Dune Digest is all about cutting through the noise and surfacing the most relevant on-chain trends. If you have insights, dashboards, or data-driven stories that belong in the Digest, drop your suggestions here.

The data must flow.

Dune Team

Ready to bring your Blockchain to Dune?

Power your App with Dune data

Steam Dune data in your analytics environment

Want to join Dune?

Dune Datashare

Ready to get started?

Individuals + Small Teams

Enterprise